5 interesting insights we gathered between UAE and African fashion brands in the new world of digital transformation while exploring the future of fashion.

As businesses rush to go online and digitally transform, knowing how to position yourself in the current market is an incredibly urgent task. Technology and competition for online space is consistently evolving so it’s simply not enough as a fashion brand to just create a website or e-commerce store anymore.

We see companies reaching their 2025 digital transformation goals in a few months due to the global pandemic. Teams working around the clock for one purpose – How can we use resources and technology to reach our goals now as if our lives depended on it!

Companies who moved quickly and who were well prepared for the shift are already reaping the benefits of their hard work. They are now starting to access and use the valuable data that assists them develop products and service their market better, staying well ahead of competitors still learning to swim!

At an ‘AI Everything’ Conference Fashion Foresight attended a few weeks ago, we heard insightful discussions from groups like Al Futtaim and Chalhoub mention how their online presence, e-commerce platforms and digital transformations are assisting them deliver the right goods to customers when and how they want it, spotting the trends and knowing exactly how to control their stocks. A goldmine of business intelligence that is helping their companies stay leaner and deliver only what’s necessary. These companies are becoming smarter and incredibly intuitive.

So how do smaller businesses in the fashion industry and fashion brands not only compete with each other but also position themselves as we head into a new world of ‘switched on’?

We saw a slow move from established fashion brands to go online and use e-commerce solutions over the years, the fashion industries endless excuses on why they won’t go fully online just yet or wary of e-commerce value, despite the ‘new world’ 2025 Forecasts, seemed to not stop the inevitable!

Bring on a global pandemic, Covid-19, established brands are now scrambling for life jackets and crash courses on how to stay afloat in shifting tides, exploring what it means to be a leaner, digital fashion brand and what is shaping the future of fashion!

At Fashion Foresight we decided to do a little investigation to understand how well prepared are Arab and African brands in our regions as we transition to online and digital.

We decided to focus on SME fashion brands located within these regions for insights on emerging markets. With the fashion industry being hard hit in 2020 we investigated to understand which brands are taking charge of their online space, preparing and eventually shifting toward the new world of digital transformations.

We accessed their online reach, their number of visits, used our intelligence to understand where their audience were really assessable, how many audiences they had in common and which Arab and African fashion brands were the leaders in the digital shift between SME’s.

We compared only for traffic to the official website, e-commerce and social media. We did not include any internal infrastructures, tools in place for their new world of digital transformations.

1. Comparing organic traffic and organic keywords used between six SME fashion brands (5 years old and less in the UAE)

In our research we had spotted one fashion brand among other SME brands that seems to be dominating the online space in their organic reach. Between 135 to 180 organic search traffic with the ability of using minimum keywords in comparison to three of its fashion competitors.

In comparing growing fashion brands in the UAE region, we had found that most are not using their online presence well, with traffic never going over 200 – 300 views per month between last quarter 2019 and first quarter 2020, however understandably spiking over the December holiday period.

Despite almost 180 hits for our top performing brand, the online traction is still incredibly low!

Interestingly UAE brands that are considered independent and established also saw low numbers in online reach within the same time line compared to fashion brands abroad.

Our top performing SME brand is getting more traffic outside of the UAE – its regional position, using its current keywords. We are unable to determine if this is a purposeful strategy by the fashion brand or a disconnect between what works between local and international markets.

We noticed that brands within the UAE were getting more traffic outside their local reach. African brands were getting traffic mostly within South Africa, Botswana and a mix of other regions.

2. Online presence between SME fashion brands in African markets (5 years old and less)

In Africa we compared 8 fashion brands from 2 regions and had a look at the top performing in the online space.

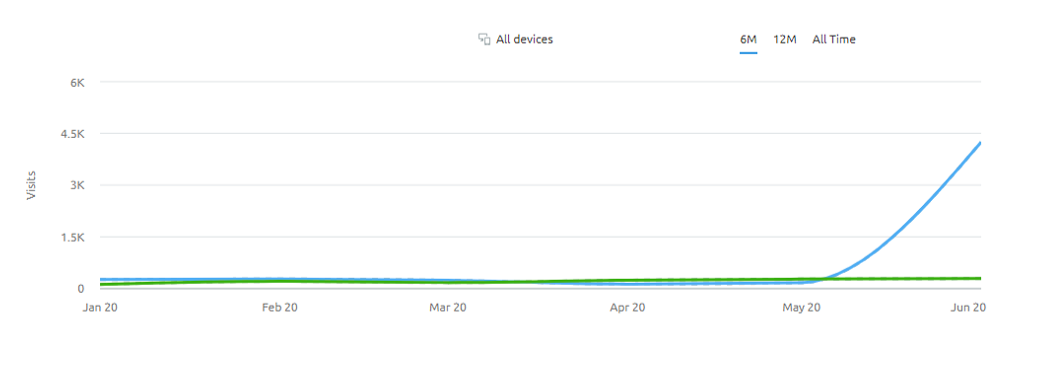

With our highest performing South African brand reaching 4.2k organic visits and interestingly, strong traffic coming in from social media during May and June 2020 despite the pandemic.

On further investigation our top performing fashion brand, with over 80k social media followers, consistently posted visually appealing images and videos despite the global pandemic. Whereas we saw a drop in content creation and posts from their competitors within the same timeline.

With audience being at home and online, it may have been a better time to gain brand awareness even if they did not convert to sales in the time period.

3. Social media is driving more fashion brands than others!

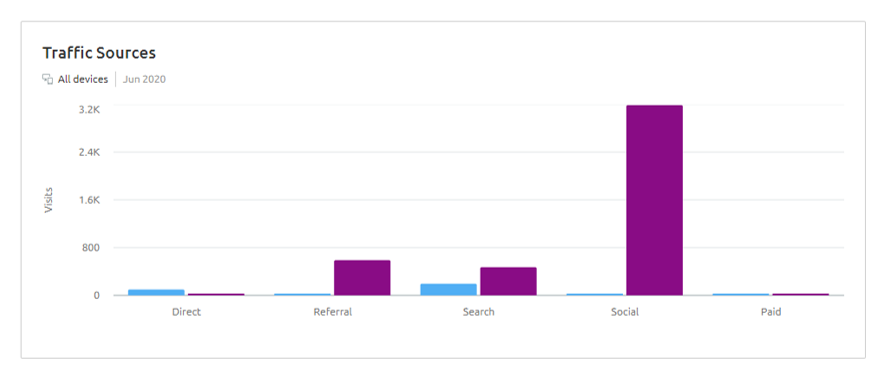

Interestingly enough, social media was the least performing for traffic between all fashion brands, brands saw more reach with direct, referral and search being the highest contributors to traffic between May and June 2020.

All the brands we compared were well known within their market but with a variety of followers in numbers.

Despite our top performing brand having less followers than its main competitor, with both having high quality imagery and videos, the brand gathered more traffic from social media.

Interestingly the brand’s main competitor, which is well known, had little to no data sets for traffic to their online spaces which indicated that despite having a website and e-commerce store it was not optimized or perhaps setup correctly.

This may indicate a few possibilities:

1. Our top performing African brand, despite having less followers, is delivering their content better to its audience

2. Our top performing African brand is investing and optimizing better in their online presence and digital content gaining good data insights.

3. Competitors may have bought followers, keeping the real data and actual traffic at realistic numbers compared to the inflated social media following.

4. Mobile is the most valuable for consumer traffic!

Comparing devices, we found that mobile was the most popular device for consumer engagement. Audiences were searching, referring and interacting with their favourite fashion brands mostly through their mobile phones. This supports the data that more than 80% of audiences are and will continue to consume content via mobile devices. This indicates where brands should focus their efforts from developing content to reaching their target market within their digital strategy for the upcoming years.

As consumer behaviour is shifting in real time we see an increase in online purchases, individuals who had never before considered to shop online have transitioned to do so and have discovered the ease of flow from purchasing essentials and the joy of at home delivery. These include older generations as well as skeptical consumers.

You can get more insights to consumers’ broader shopping behaviour on Bigcommerce and locally in Gulf News article, insights in understanding which industries and products are doing well on e-commerce and how we have responded differently from gender to generations.

Conclusion

In gaining insights of up and coming fashion brands in UAE and Africa, we found that most were not using their online spaces correctly with sporadic data, a few holes in available data and broken channels of communication. Some brands were also reaching the wrong audiences finding themselves out side of their target market whether it was age, gender or location.

We also found that despite the pandemic a few brands continued to remain consistent in engaging with their audience, creating further brand awareness and appeal. Keeping their audience’s attention and creating a connection.

What does this mean for SME fashion brands?

As technology and standards evolve, it appears it’s no longer enough to just set up your website or e-commerce store on Shopify to earn your online badge and hope for the best!

Knowing exactly how to position yourself online and gain the intelligence between your audience and competitors is incredibly important as fashion brands all compete for online space as we prepare for the future of fashion.

Keeping in mind that bigger brands are adjusting and preparing for the future of fashion, we recommend that SME fashion brands on the rise should hold on to what makes them special or unique, gain more insights about their audience, fix their online channels and start collecting data efficiently, ultimately making them smarter, intuitive and eventually investing in resources and content correctly.

5. We did a check list that brands can include in their journey to online, see which of the below you have already included for your strategy.

• Market research and market intelligence

• Brand identity

• Website

• Ecommerce platform

• Correct social media platforms in place and in use

• Infrastructures

• Data and analytics

• Content and engagement

• Competitor Intelligence

• Business Intelligence

If you found this article useful and need assistance with your brand in analyzing your position in the market and gain the necessary intelligence, contact us here.

Fashion Foresight can assist your brand with industry forecasts, data and intelligence, market research and immersive experiences.